Even as industry experts disagree on what to call them or how to define them, the phenomenon of new and mostly empty real estate developments in Chinese cities continues to grow.

Wuhan, Nanjing and Hefei are among a number of large cities that have been affected by the “ghost town” syndrome. It usually works like this: the local government hastily decides to undergo property development projects as a way to promote GDP growth and urbanization, but there is little to no market demand for the properties. Therefore they remain empty.

According to the national statistics bureau, 12 percent of China’s GDP in 2014 came from new property development, the same amount as year before. However, there are more and bigger “ghost towns” being built as a result, which is a growing problem.

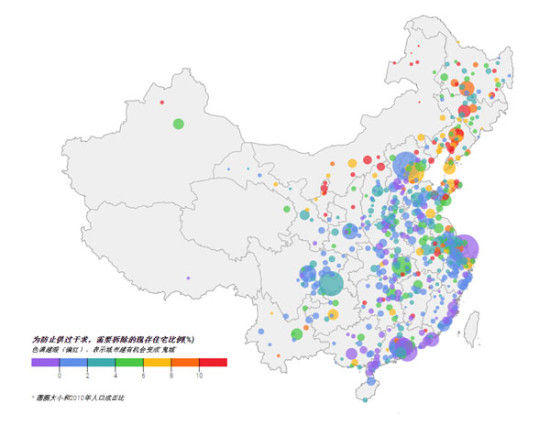

Chinese economist Chen Qin has created a national map of ghost towns. It is based on two variables: future expected supply and demand, and a comparison with the number of existing residential units in a city. Chen admits this system of mapping ghost towns is flawed, but will help predict which cities will have more supply than demand in the coming years. The map shows most ghost cities are in heavily industrialized and urban areas along China’s east coast.

A 2014 report by CLSA followed 609 real estate developments in 12 Chinese cities from 2009 to 2014 and discovered they had a vacancy rate of about 15 percent, resulting in 10.2 million vacant units.A 2014 report by CLSA followed 609 real estate developments in 12 Chinese cities from 2009 to 2014 and discovered they had a vacancy rate of about 15 percent, resulting in 10.2 million vacant units. The rate jumps to 17 percent when including low cost rental units far from the city center. By comparison, the USA has vacancy rate of 10 percent.

Ordos, Inner Mongolia, is the most well-known example of a ghost town in China, and Chen and CLSA both agree that the situation there will continue to worsen over the next five years. Despite that, many cities continue to push forward with large scale development projects. For example, Guizhou, Guiyang, is hoping to attract 500,000 new residents by investing RMB 90 billion in real estate projects that are each over 100,000 square meters in size. However, Guizhou has failed to attract new residents because it has few employment opportunities, as have 74 other mid and small-sized cities like Sanya, Changzhou, Ganzhou, and Wenzhou.

Compounding the problem of “ghost towns” is the fact that the government has never released any official data on the subject, having never reached a consensus on how best to define or measure it. The China Real Estate Information Corporation (CRIC) said the term “ghost town” is “irresponsible” in a 2013 report.